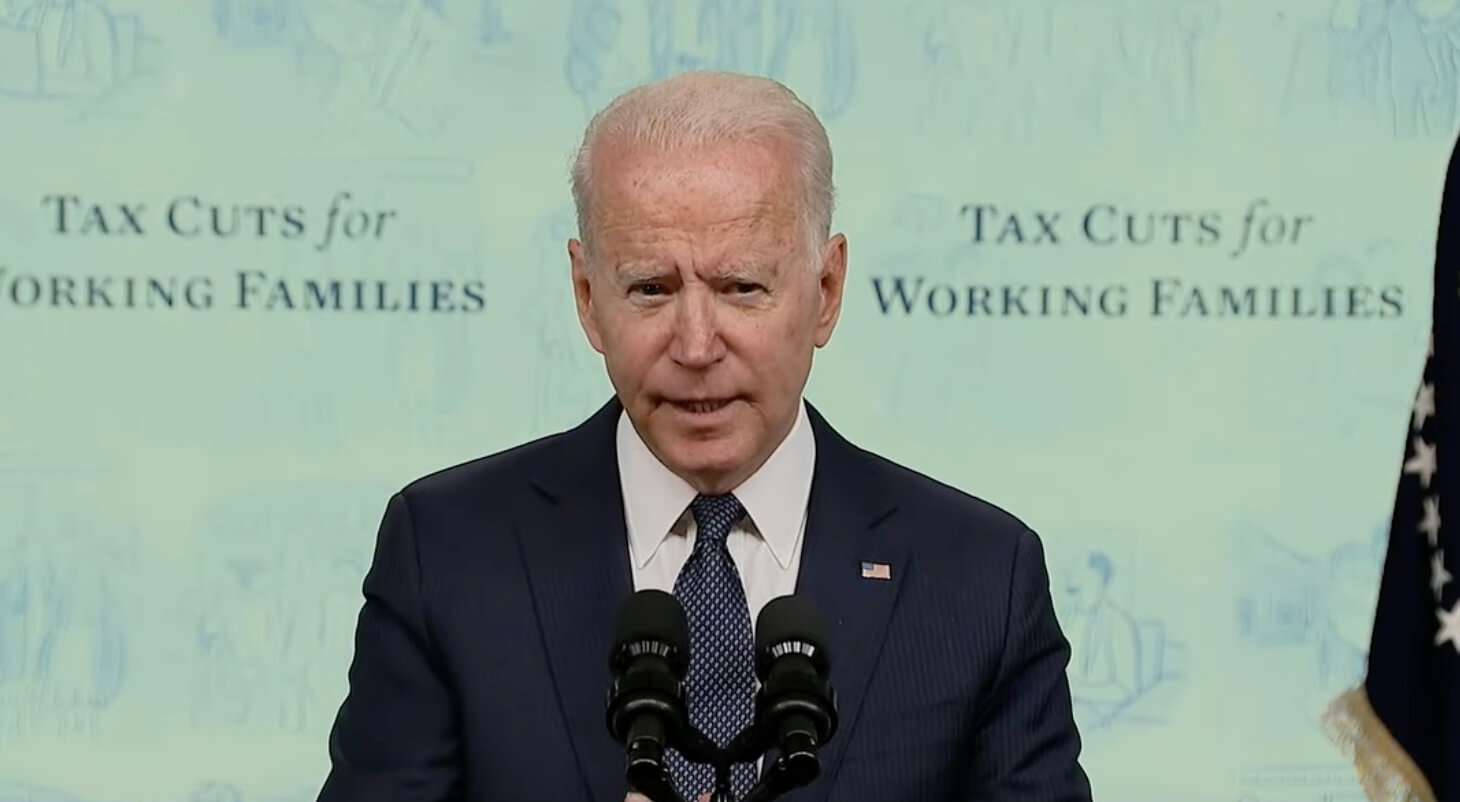

While opening my mail a few days ago, I noticed a letter from the White House signed by President Joe Biden explaining the American Rescue Plan that was passed on March 11.

This plan is intended to help millions of American families fight public health and economic challenges caused by the pandemic.

Besides the stimulus checks from April, this plan includes an expanded child tax credit (CTC). This refundable tax credit is not a new concept, but an expanded version of what many families were already acquainted with.

Think of it more like a cash advance of your tax credit.

For every child aged 6-17, the credit is $3,000. For every child under age 6, it’s $3,600. Monthly payments of $250 or $300 started arriving Thursday and continue until Dec. 15, although people can opt-out and receive the credit when they file their 2021 taxes.

I wondered if families were considering taking advantage of it and, if they were, how they planned to use it — you don’t need to do anything to receive the payments.

I asked some people and got a wide range of responses.

Karla Rangel of Des Moines, who has two kids, Hunter, 15, and Henry, 13, told me she declined to receive the CTC monthly payments.

“Unless you are really behind on bills or rent, or you lost income due to the COVID-19, this is a very short-term fix because when you do your taxes for 2021, it will be deducted,” she said.

That’s not quite the full picture — receiving the payments now doesn’t mean you have to pay them back next year, unless your income level changes drastically upward between last year and this tax year. You may not get as big a tax return next year since, even though the usual child tax credit has been increased, with the prepayments, but overall families are still receiving more.

David Quiñones of Des Moines said he is worried about broader inflation and all the prices going up. A few examples he mentioned were insurance for his car and mortgage, his mortgage, and gasoline.

Although one major use of the tax credit could be paying for child care, a daycare owner friend of mine wasn’t really familiar with it.

To my surprise, not everyone was on the same page as far as understanding or utilizing the expanded child tax credit, yet a couple of things are clear: The rollout could have used better marketing and some families will definitely benefit from it.

The pandemic has put families in health and financial peril, so any help will certainly come in handy, something Luz Paredes of Des Moines shared with me. Paredes has a 3-year-old daughter and is counting on that $300 a month.

“I accepted the child tax credit because it will help me out,” she said. “Due to COVID and health issues, and a car accident, I got behind in my bills.”

by Claudia Thrane

Posted 07/15/21

1 Comment on "Thrane: Child Tax Credits Will Help, but Some Choosing to Wait"

Excellent article! Unfortunately many of the recipients of the Child Tax Credit will burn through that early cash like a “payday loan.”